Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

Everyday, lawyers have to navigate conflicts of interest to determine when they can take on a new representation or when they must withdraw from an existing one. This CLE will cover the more complicated conflict of interest scenarios—the so-called “hot potato” doctrine and “thrust-upon” conflicts.

The CLE will describe the critical provisions of Rule 1.7 (current client conflicts) and Rule 1.9 (former client conflicts) as well as common law created doctrines that govern disqualification proceedings. It will conclude by providing practical guidance on how to avoid conflicts and how best to navigate them should they nonetheless arise.

In “Choosing the Right Business Entity,” I will walk through the issues that matter most...

Part 2 - This program will continue the discussion from Part 1 focusing specifically on cross?examin...

Boundaries and Burnout: The Hidden Crisis in Law is a 60-minute California MCLE Competence Credit pr...

This CLE session introduces attorneys to budgeting and forecasting concepts used in corporate planni...

This program explores listening as a foundational yet under-taught lawyering skill that directly imp...

The direct examination presentation outlines how attorneys can elicit truthful, credible testimony w...

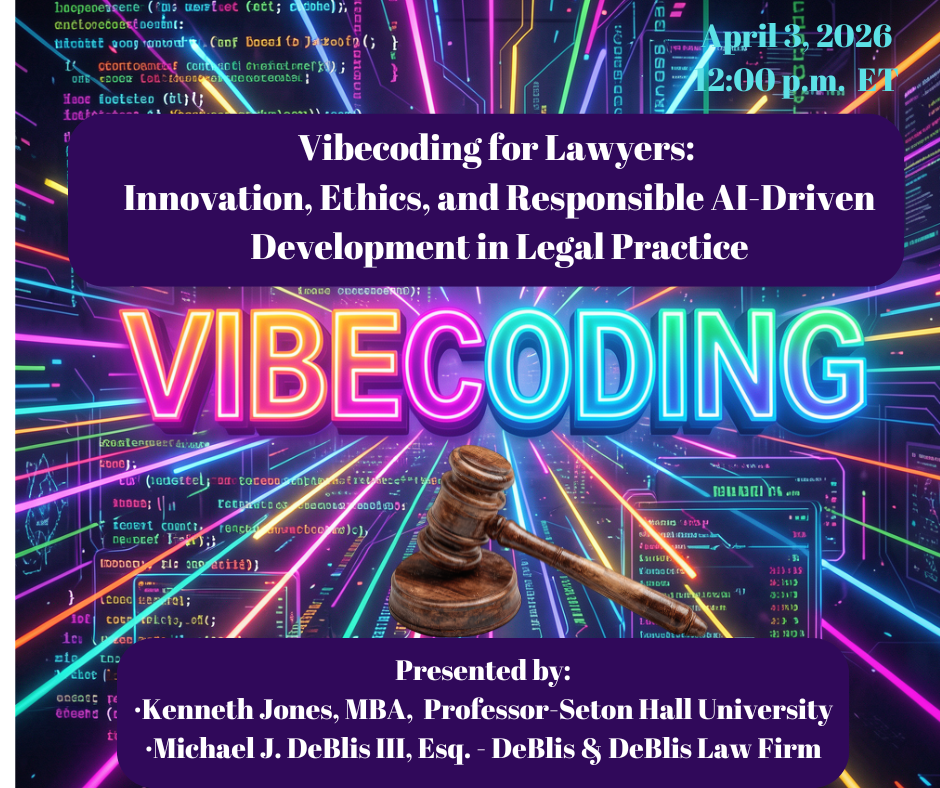

Artificial intelligence is already reshaping legal practice, from research and drafting to litigatio...

Evidence Demystified Part 1 introduces core evidentiary principles, including relevance, admissibili...

This program provides attorneys with a practical and ethical framework for understanding and respons...

The filing of multiple RICO complaints in federal courts in New York State against plaintiffs’...