Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

Are you as knowledgeable in the Fair Lending regulations? Do you know how they pertain to your role and responsibilities? Has your compliance program changed with the changes in regulations? Fair Lending for financial institutions encompasses a group of laws and regulations prohibiting discrimination in the extension of credit to consumers. Failing to follow the fair lending compliance regulations can result in civil money penalties, restrictions on branching and significant reputational damage for an institution.

During this webinar we will go through each of the regulations that fall under Fair Lending. Fair Lending for financial institutions encompasses a group of laws and regulations prohibiting discrimination in the extension of credit to consumers. Failing to follow the fair lending compliance regulations can result in civil money penalties, restrictions on branching and significant reputational damage for an institution.

The direct examination presentation outlines how attorneys can elicit truthful, credible testimony w...

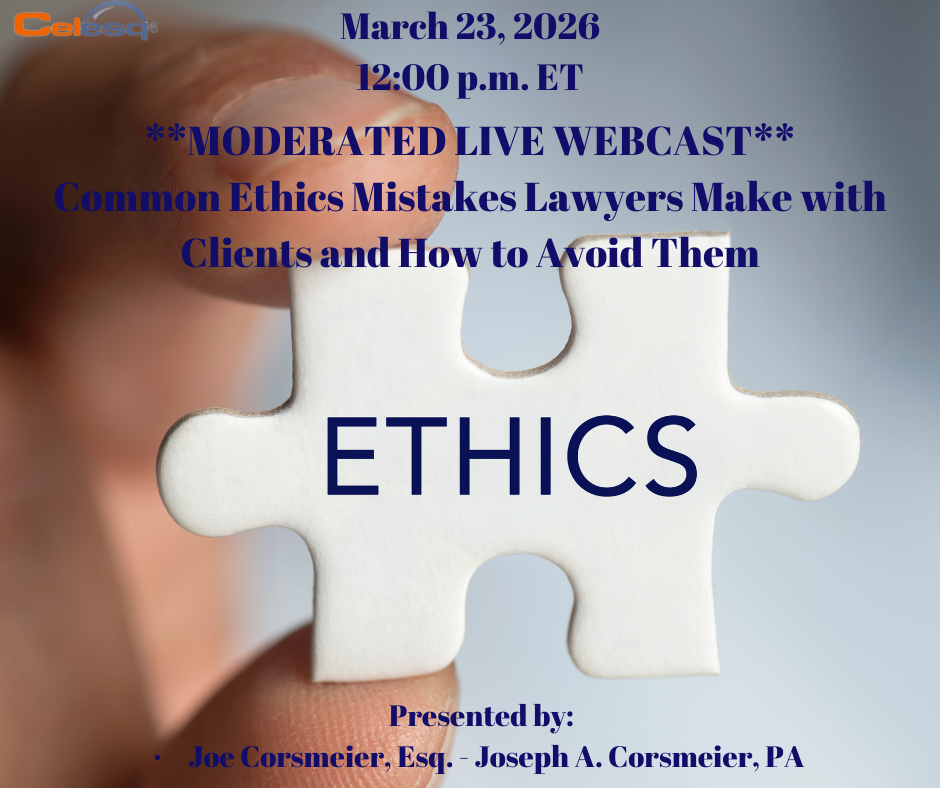

Many lawyers may not fully understand the Bar rules and ethical considerations regarding client repr...

This Shakespeare?inspired program illustrates how Shakespearean technique can enrich courtroom advoc...

This course breaks down GAAP’s ten foundational principles and explores their compliance impli...

Part 1 - This program focuses specifically on cross?examining expert witnesses, whose credentials an...

In “Choosing the Right Business Entity,” I will walk through the issues that matter most...

The landscape of global finance is undergoing a seismic shift as traditional assets migrate to the b...

Attorneys hopefully recognize that, like many other professionals, their lives are filled to the bri...

Resilience in the Workplace, delves into the critical importance of resilience in navigating the cha...

Review the basic software concepts and effective uses of generative AI, prompting strategies, and me...