Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

This program will guide attorneys in the practical implications of compliance with the newly enacted Corporate Transparency Act and New York LLC Transparency Act, including advising clients, analyzing compliance requirements through case-based examples, modifying agreements to incorporate appropriate provisions, and assessing whether to provide services in this area given the steep penalties for non-compliance. Attorneys will learn to identify key reporting obligations, develop compliance strategies, and understand how these laws affect their clients’ organizational structures and operations. Key learning objectives include effective client counseling, risk mitigation, and ensuring that internal and external documents align with legal standards.

Effective data privacy and artificial intelligence governance programs do not happen by accident. Th...

This course clarifies the distinction between profit and cash flow from a legal perspective. Attorne...

Navigating Stress and Trauma in the Legal Profession, explores the unique challenges faced by legal ...

This program examines critical 2025-2026 developments in patent eligibility for software and AI inve...

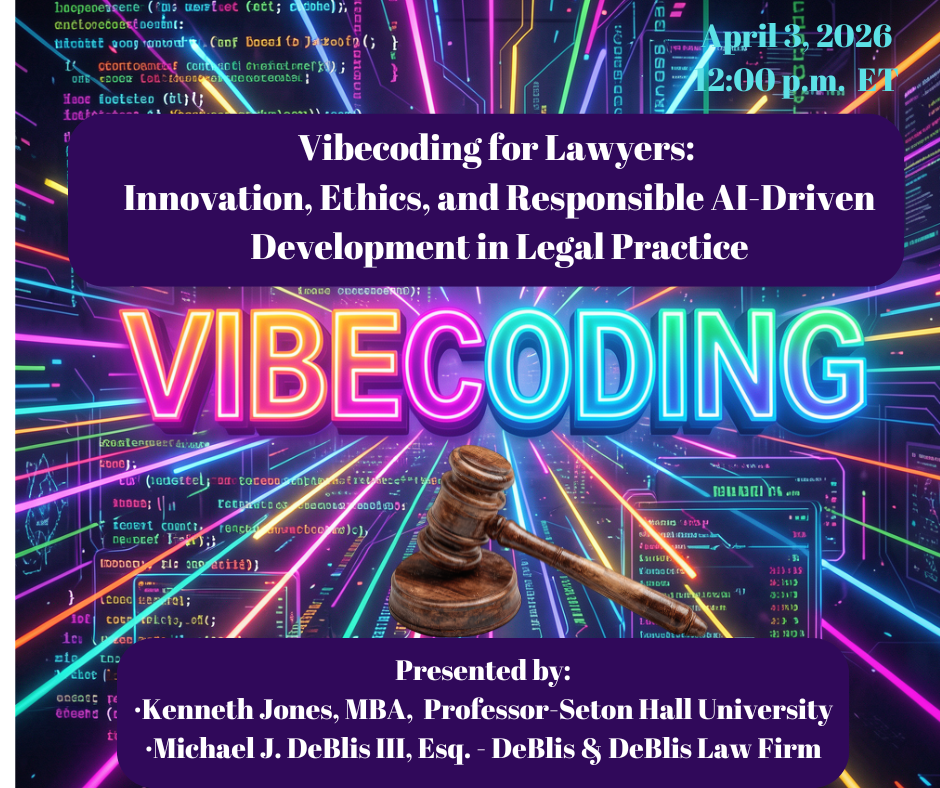

Artificial intelligence is already reshaping legal practice, from research and drafting to litigatio...

This program provides attorneys with a practical and ethical framework for understanding and respons...

Recent studies have shown that there has been a dramatic increase in impairment due to alcoholism, a...

United States patent law and the United States Patent and Trademark Office’s patent-related gu...

If there is one word we heard during our journey through the pandemic and continue to hear more than...

This presentation teaches attorneys how to deliver memorized text—especially openings and clos...