Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

In a recently released transcript, Rudy Giuliani told federal agents it was permissible to “throw a fake” during an electoral campaign. Just weeks before that transcript became public, Giuliani was suspended from the practice of law in New York for baselessly asserting that thousands of felons and dead people voted during the 2020 presidential election and that Georgia voting machines had been manipulated.

This program will examine the ethics rules implicated by Giuliani’s recent conduct—ABA Rules 1.2, 3.3, 4.1, and 8.4—and provide guidance on how to avoid suffering Rudy’s fate.

This course breaks down GAAP’s ten foundational principles and explores their compliance impli...

This program examines listening as an active, strategic trial advocacy skill rather than a passive c...

United States patent law and the United States Patent and Trademark Office’s patent-related gu...

Contracting with the Federal Government is not like a business deal between two companies or a contr...

The “Chaptering Your Cross” program explains how dividing a cross?examination into clear...

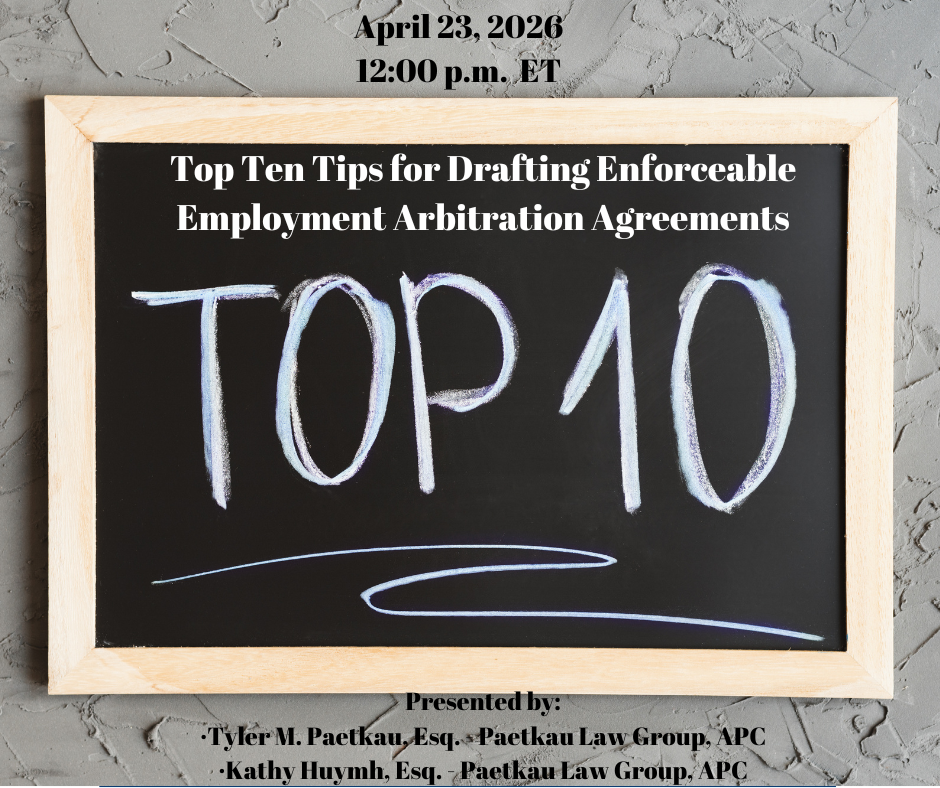

In the rapidly evolving landscape of employment law, arbitration agreements have become a cornerston...

Part II builds on the foundation established in Part I by examining how classical rhetorical styles ...

Evidence Demystified Part 1 introduces core evidentiary principles, including relevance, admissibili...

This program focuses on overcoming the inner critic—the perfectionist, self?doubting voice tha...

This Shakespeare?inspired program illustrates how Shakespearean technique can enrich courtroom advoc...