Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

This CLE course will provide employment counsel and tax advisers guidance for structuring complex settlements and complying with complex tax reporting and withholding requirements applicable to employment claims and related attorneys fees.

I will discuss best practices for employers and attorneys to structure settlements, maximize tax benefits, and avoid penalties when allocating settlement proceeds. I will also discuss the tax information reporting requirements for payments to claimants and their counsel as well as the tax implications of plaintiff requests in settlement agreements.

This program examines critical 2025-2026 developments in patent eligibility for software and AI inve...

This program provides a detailed examination of the Black Market Peso Exchange (BMPE), one of the mo...

Attorneys are judged every time they speak—in client meetings, depositions, hearings, negotiat...

Explore the transformative potential of generative AI in modern litigation. “Generative AI for...

Review the basic software concepts and effective uses of generative AI, prompting strategies, and me...

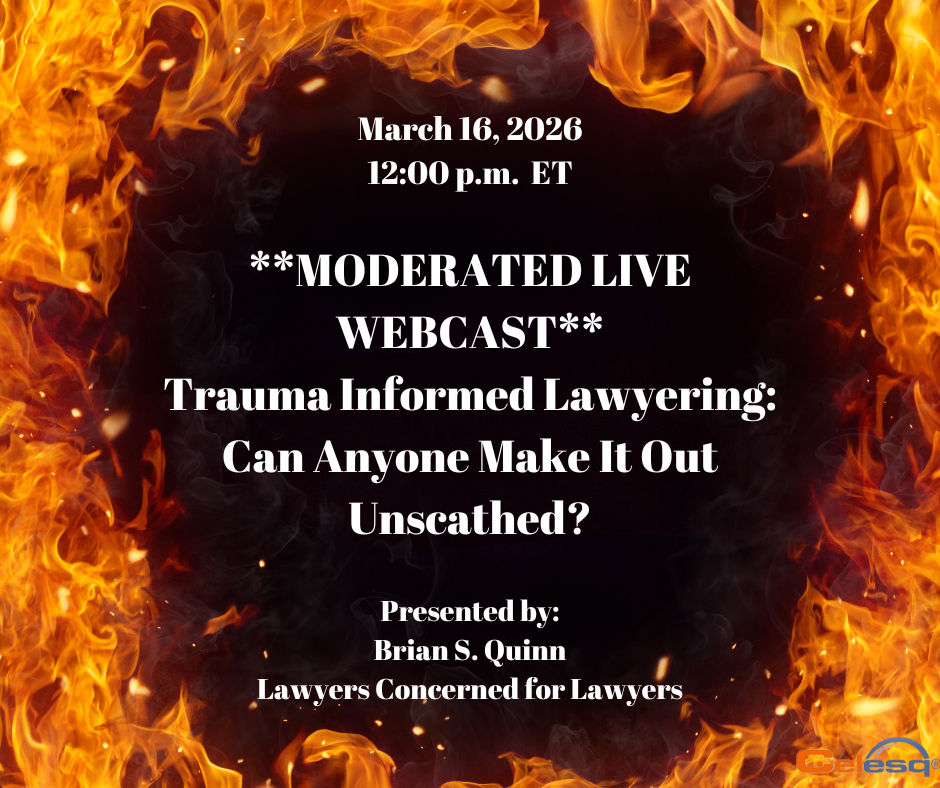

In high-stakes, high-pressure environments like the legal field, even the most accomplished professi...

This attorney-focused program reviews upcoming Nacha rule changes for 2026 with emphasis on legal ob...

Aligning Your Legal Career with Your Values, explores the profound impact of values alignment on ind...

If there is one word we heard during our journey through the pandemic and continue to hear more than...

Attorneys hopefully recognize that, like many other professionals, their lives are filled to the bri...