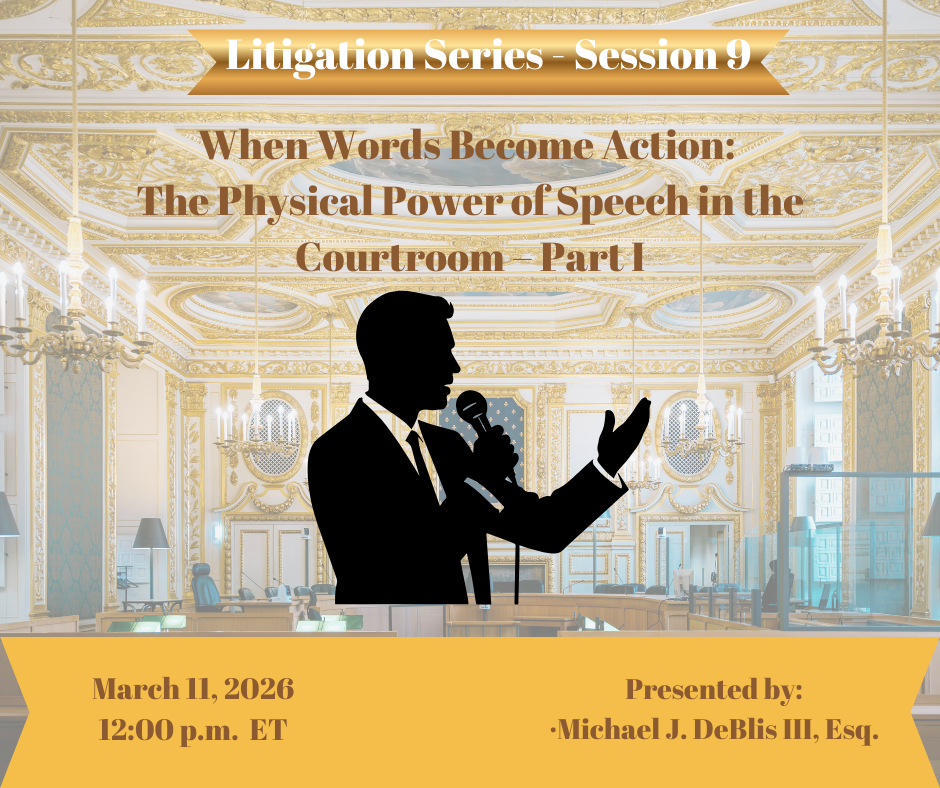

Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

FINRA arbitration, an alternative dispute resolution process that is mandatory for most broker-dealer customer and industry disputes, is a quirky process that poses many unique and difficult challenges for legal counsel with little to no experience with the process. Even for seasoned practitioners in the FINRA forum, challenges abound.

This webinar will focus on best practices for handling certain recurring issues confronted by counsel in FINRA arbitration, including but not limited to defending against legally meritless claims and counterclaims (FINRA rules effectively prohibit arbitrators from dismissing facially deficient claims prior to a full evidentiary hearing) and meeting the heavy burden of proof in cases where a broker may seek to have a settled/denied/withdrawn customer dispute expunged or challenge the grounds for termination reported on Forms U4/U5. The presenters also will outline FINRA’s arcane process of arbitrator selection and provide insights on how to best identify and rank qualified and potentially receptive arbitrators.

Part I introduces the foundational principles of cross?examination, explaining how lawyers must meth...

You’ve arranged to speak with a reporter. Do you know how to deliver insights that are memorab...

The Civil RICO framework allows individuals and businesses to pursue legal action for damages from a...

Evidence Demystified Part 1 introduces core evidentiary principles, including relevance, admissibili...

AI tops the news seemingly every day. The technology is growing in use and application as lawyers, c...

Tailored for attorneys, this training demystifies EBITDA and contrasts it with GAAP- and IFRS-based ...

This presentation examines how “sense memory,” a core acting technique, can help lawyers...

This program focuses on overcoming the inner critic—the perfectionist, self?doubting voice tha...

This comprehensive program synthesizes theatrical technique, psychology, communication theory, and t...

Bias and discrimination continue to shape workplace dynamics, legal practice, and professional respo...