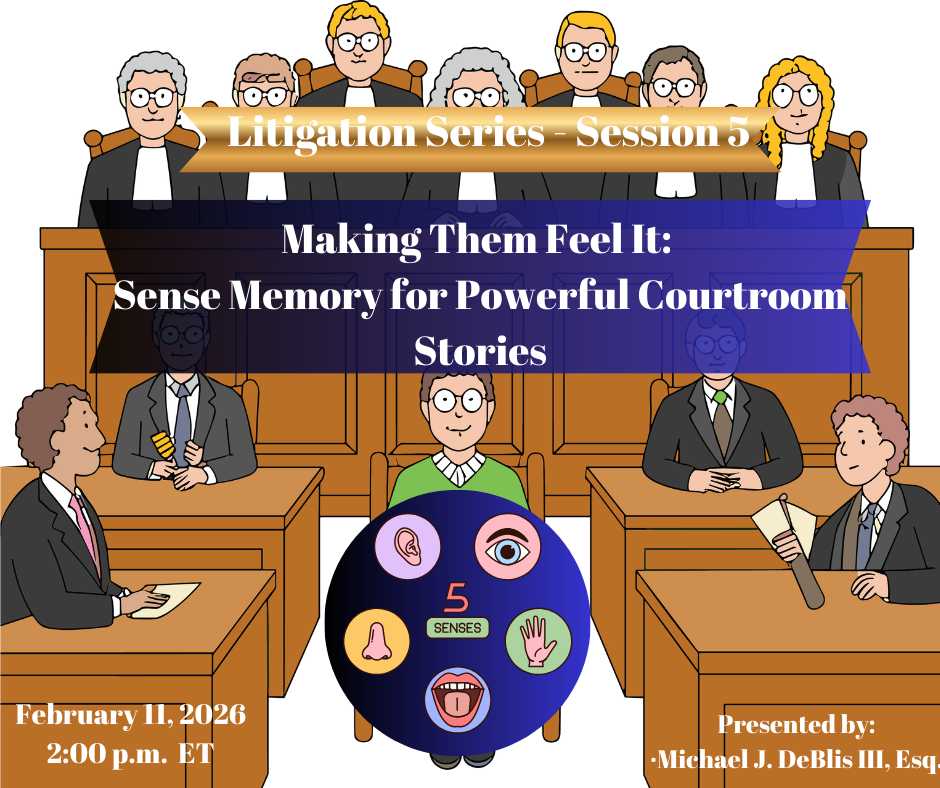

Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

In “Choosing the Right Business Entity,” I will walk through the issues that matter most when forming and operating a company. Topics to be discussed will include management structures, tax matters (e.g., pass-through versus corporate taxes), entity-type classifications and eligibility requirements, equity-based incentives, ownership transfers, and succession planning, among others. Expect a candid discussion of the differences between LLCs, partnerships, C corps, S corps, and sole proprietorships, with real-life examples showing how structure impacts ownership, governance, taxes, capital, business exits, and so much more.

This presentation examines how “sense memory,” a core acting technique, can help lawyers...

Tailored for attorneys, this training demystifies EBITDA and contrasts it with GAAP- and IFRS-based ...

This advanced CLE dives into complex GAAP topics relevant to attorneys advising corporate, regulator...

Large World Models (LWMs)— the next generation of AI systems capable of generating...

This attorney-focused program reviews upcoming Nacha rule changes for 2026 with emphasis on legal ob...

Part II builds on the foundation established in Part I by examining how classical rhetorical styles ...

Designed for attorneys without formal accounting training, this course provides a clear, practical f...

Evidence Demystified Part 1 introduces core evidentiary principles, including relevance, admissibili...

This ethics program examines common, but often avoidable, professional responsibility mistakes that ...

Attorneys will receive a comparative analysis of GAAP and IFRS with emphasis on cross-border legal c...