Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

This presentation will cover the following. Tax Court is based in Washington, D.C., but its judges travel to hear cases on regular calendars in various cities around the country.

At trial, the TP may be represented by anyone admitted to practice before the Tax Court, which includes non-attorneys who have passed an exam. The IRS is represented in Tax Court by attorneys from the IRS Chief Counsel’s Office.

U.S. Tax Court applies the rules of evidence applicable in trials w/o a jury in the U.S. District Court of the District of Columbia. U.S. Tax Court follows its own procedural rules. In this presentation, we will deliver into these rules.

Successful personal injury defense practice requires far more than strong legal arguments—it d...

This program focuses on overcoming the inner critic—the perfectionist, self?doubting voice tha...

This course provides a strategic roadmap for attorneys to transition from administrative burnout to ...

This course breaks down GAAP’s ten foundational principles and explores their compliance impli...

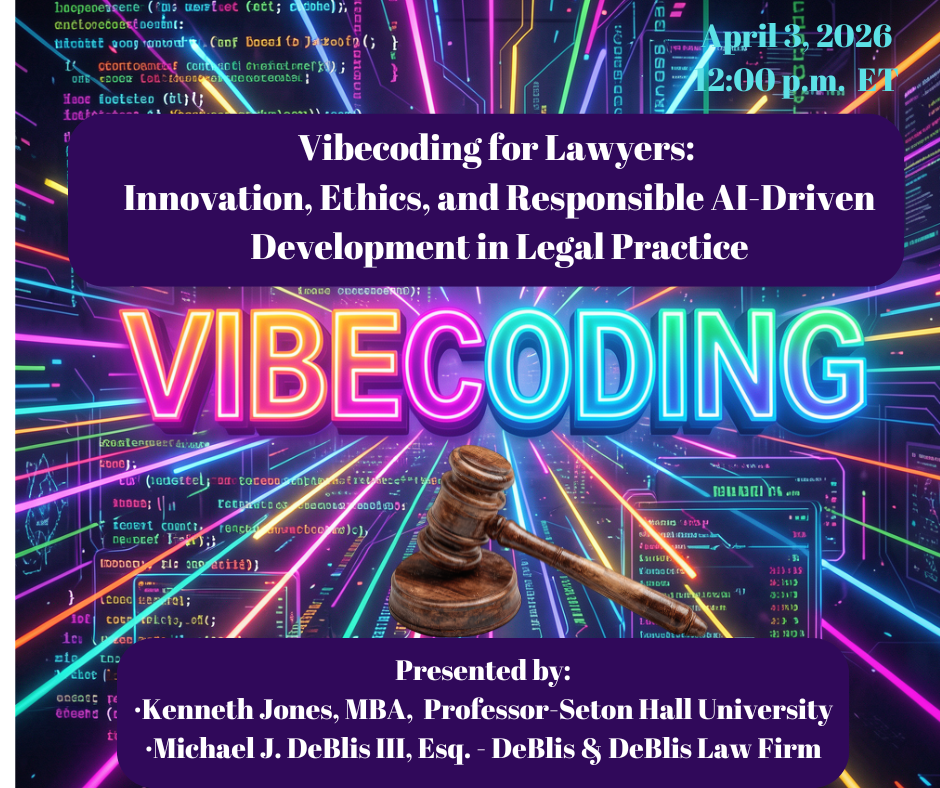

Artificial intelligence is already reshaping legal practice, from research and drafting to litigatio...

United States patent law and the United States Patent and Trademark Office’s patent-related gu...

This program provides attorneys with a practical and ethical framework for understanding and respons...

The filing of multiple RICO complaints in federal courts in New York State against plaintiffs’...

This CLE session introduces attorneys to budgeting and forecasting concepts used in corporate planni...

The landscape of global finance is undergoing a seismic shift as traditional assets migrate to the b...