Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

Across the country, traditional noncompete agreements are under increasing judicial and legislative scrutiny. This series will discuss these developments, as well as the prospect of federal legislation or regulation, and will provide practical guidance to employers across the country as they seek to protect their workforces, customers, clients, and trade secrets in the years to come.

Topics to be covered include: alternatives to traditional noncompetes, such as nonsolicitation clauses, garden leave provisions, and forfeiture for competition provisions; best practices for multi-state employers with respect to noncompetition; and best practices for protecting trade secrets.

Part 2 of a 3 part series.

This program provides a comprehensive analysis of the Sixth Amendment Confrontation Clause as reshap...

This course breaks down GAAP’s ten foundational principles and explores their compliance impli...

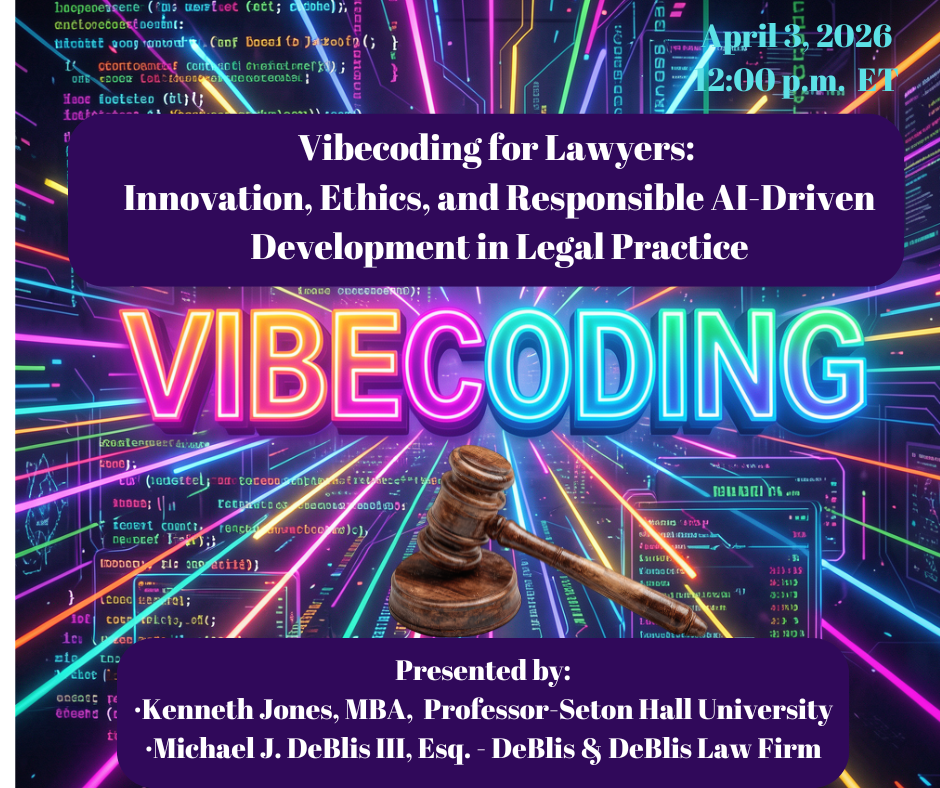

Artificial intelligence is already reshaping legal practice, from research and drafting to litigatio...

This program provides attorneys with a practical and ethical framework for understanding and respons...

Review the basic software concepts and effective uses of generative AI, prompting strategies, and me...

The CLE will cover the Ins and Outs of Internal Corporate Investigations, including: Back...

The filing of multiple RICO complaints in federal courts in New York State against plaintiffs’...

Resilience in the Workplace, delves into the critical importance of resilience in navigating the cha...

Contracting with the Federal Government is not like a business deal between two companies or a contr...

The direct examination presentation outlines how attorneys can elicit truthful, credible testimony w...