Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

The seminar will explore the advantages and disadvantages of a variety of trust strategies and other arrangements currently available to retirement plan owners who do not wish leave their retirement plans outright to their heirs at death. Trust strategies to be discussed include conduit trusts, accumulation trusts, and testamentary charitable remainder unitrusts. Charitable gift annuities and outright bequests to donor advised funds and private foundations comprise the other arrangements to which attention will be given. Each trust strategy and each other arrangement will be examined for use with each of the five types of eligible designated beneficiary and also with heirs who do not qualify as such.

‘A Lawyer’s Guide To Mental Fitness’ is a seminar designed to equip professionals ...

Evidence Demystified Part 1 introduces core evidentiary principles, including relevance, admissibili...

Recent studies have shown that there has been a dramatic increase in impairment due to alcoholism, a...

Artificial intelligence is already reshaping legal practice, from research and drafting to litigatio...

The filing of multiple RICO complaints in federal courts in New York State against plaintiffs’...

Evidence Demystified Part 2 covers key concepts in the law of evidence, focusing on witnesses, credi...

This program provides a comprehensive analysis of the Sixth Amendment Confrontation Clause as reshap...

This program provides a detailed examination of the Black Market Peso Exchange (BMPE), one of the mo...

In this seminar, we will talk about the process of taking a deposition, why you should (or should no...

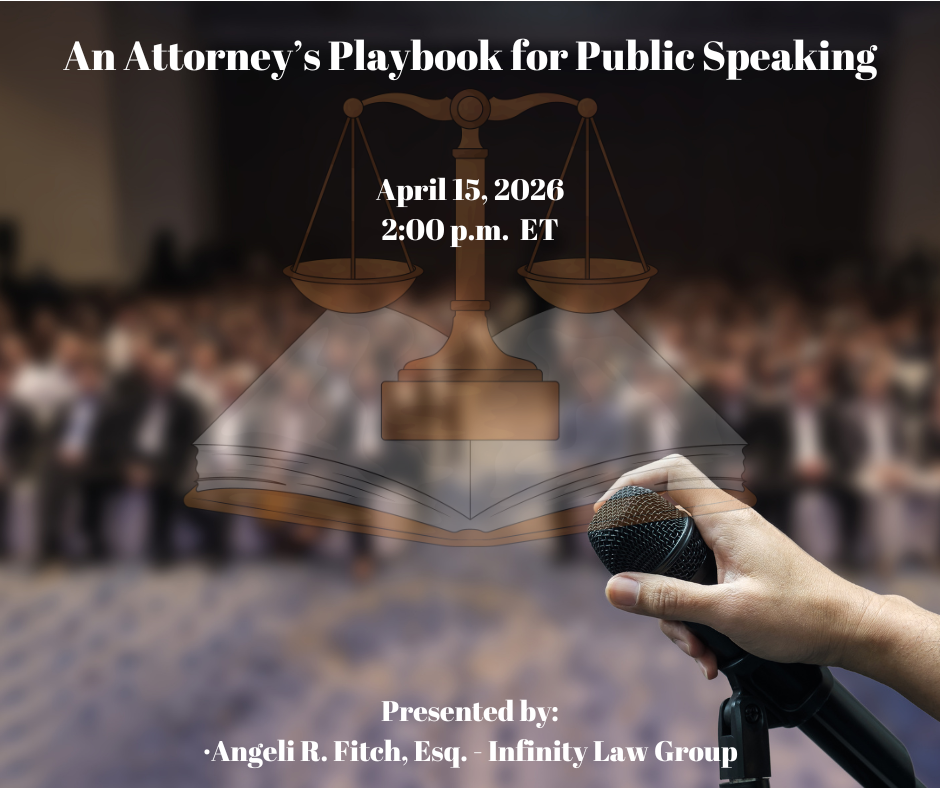

Attorneys are judged every time they speak—in client meetings, depositions, hearings, negotiat...