Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

Roy will first cover how to ensure a judgment is properly recorded. Then, he will review the mechanisms in which to collect on a judgment, e.g., continuing writ of garnishment (wages/salary), writ of garnishment of bank accounts, and levy on real and personal property. Finally, he will demonstrate the many pitfalls of Florida exemption laws which may preclude collection of judgments.

Learn about the latest trends in Federal Suspension and Debarments. This presentation will assist yo...

Large World Models (LWMs)— the next generation of AI systems capable of generating...

Recent studies have shown that there has been a dramatic increase in impairment due to alcoholism, a...

Successful personal injury defense practice requires far more than strong legal arguments—it d...

Attorneys hopefully recognize that, like many other professionals, their lives are filled to the bri...

This dynamic and compelling presentation explores how chronic stress, sleep deprivation, and substan...

Evidence Demystified Part 2 covers key concepts in the law of evidence, focusing on witnesses, credi...

Disasters, whether natural or manmade, happen. Disasters can impact the practice of law and, among o...

This program provides attorneys with a practical and ethical framework for understanding and respons...

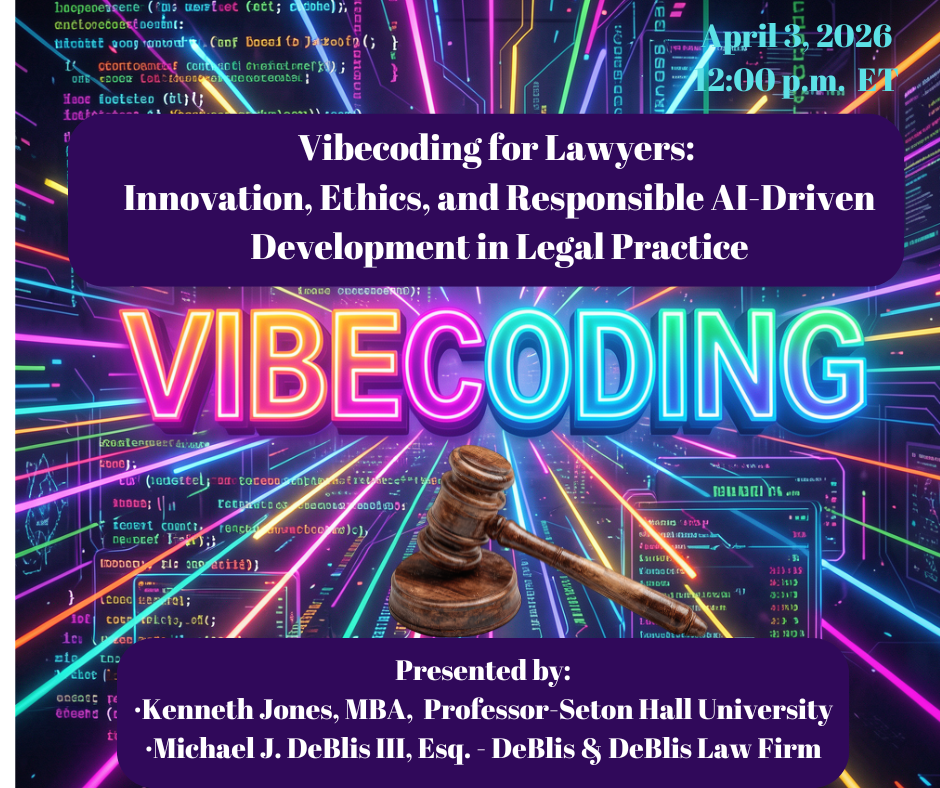

Artificial intelligence is already reshaping legal practice, from research and drafting to litigatio...