Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

In this presentation, tax attorney Mike DeBlis explains Kovel agreements and discusses the case that gave rise to them.

Part 2 - This program will continue the discussion from Part 1 focusing specifically on cross?examin...

Navigating Stress and Trauma in the Legal Profession, explores the unique challenges faced by legal ...

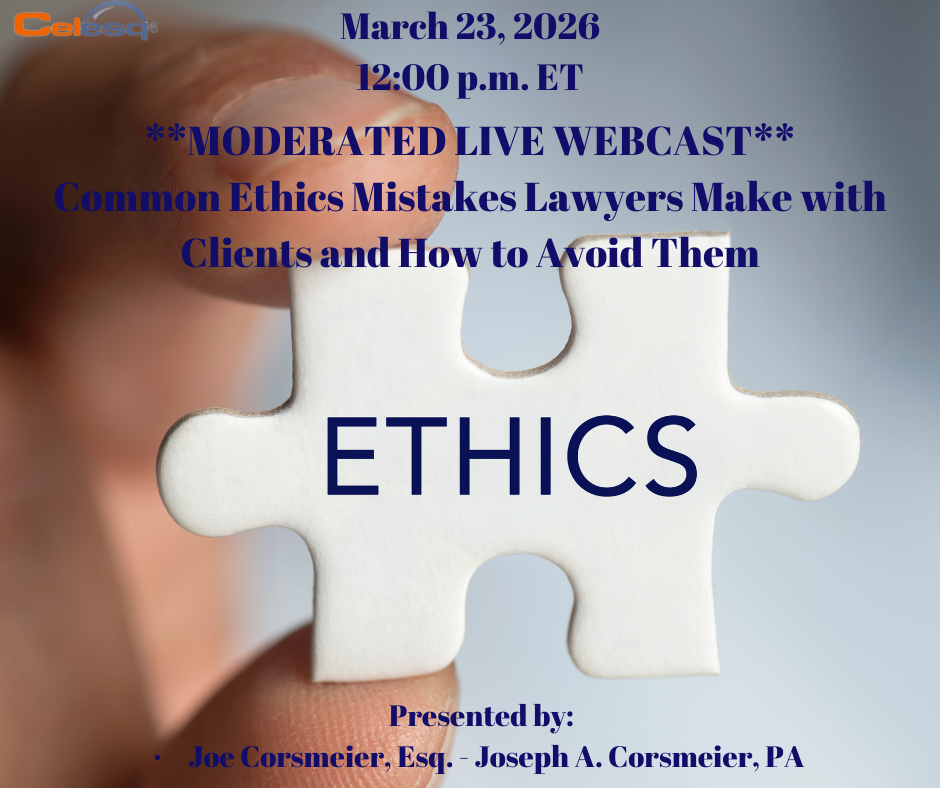

Many lawyers may not fully understand the Bar rules and ethical considerations regarding client repr...

Loneliness isn’t just a personal issue; it’s a silent epidemic in the legal profession t...

Explore the transformative potential of generative AI in modern litigation. “Generative AI for...

This CLE session introduces attorneys to budgeting and forecasting concepts used in corporate planni...

Evidence Demystified Part 1 introduces core evidentiary principles, including relevance, admissibili...

Recent studies have shown that there has been a dramatic increase in impairment due to alcoholism, a...

This session highlights the legal and compliance implications of divergences between GAAP and IFRS. ...

Attorneys are judged every time they speak—in client meetings, depositions, hearings, negotiat...