Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

A practical overview designed for attorneys new to financial reporting. The session connects GAAP concepts to legal contexts, including fraud cases, merger and acquisition due diligence, financial disclosures, and regulatory examinations, giving practitioners a solid baseline for interpreting accounting information in legal work.

Part 2 dives deeper into advanced cross?examination techniques, teaching attorneys how to maintain c...

The False Claims Act continues to be the federal Government’s number one fraud fighting tool. ...

This program examines the strategy and artistry of closing argument, positioning it as a lawyer&rsqu...

Part 1 of 2 - Lawyers at all levels of experience and even sophisticated law firms and general couns...

Evidence Demystified Part 2 covers key concepts in the law of evidence, focusing on witnesses, credi...

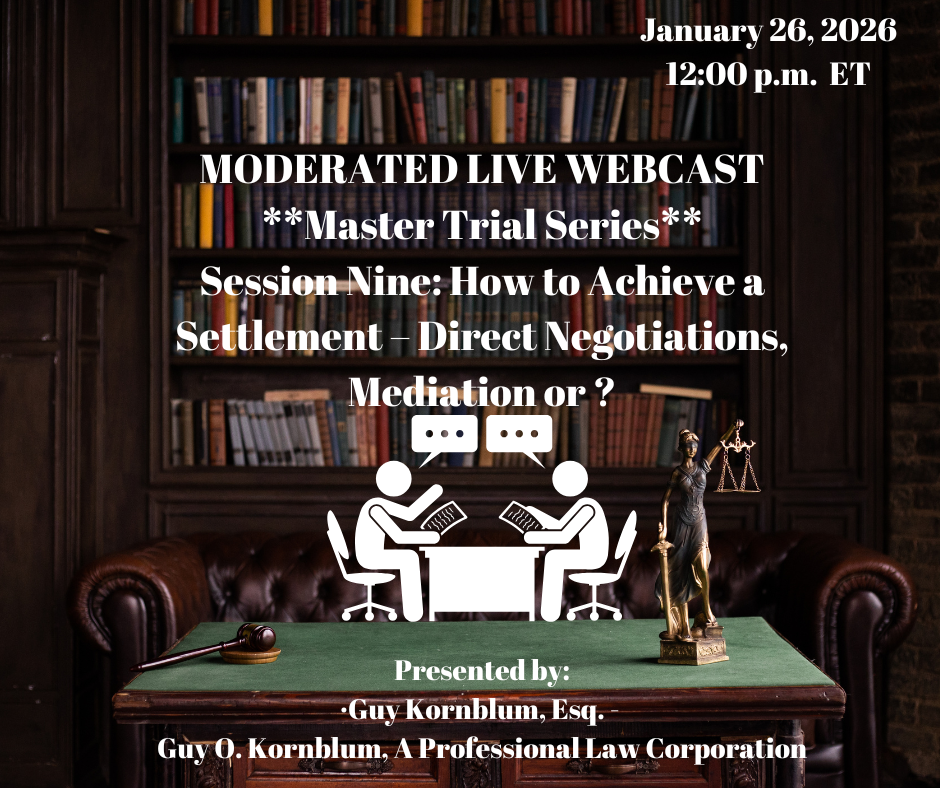

MODERATED-Session 9 of 10 - Mr. Kornblum, a highly experienced trial and litigation lawyer for over ...

Attorneys will receive a comparative analysis of GAAP and IFRS with emphasis on cross-border legal c...

This session highlights the legal and compliance implications of divergences between GAAP and IFRS. ...

This presentation teaches attorneys how to deliver memorized text—especially openings and clos...

Evidence Demystified Part 1 introduces core evidentiary principles, including relevance, admissibili...