Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

Diversification asset allocation, and rebalancing has not helped your recent 401(k) investment returns. You continue to struggle with “What do I buy?” on your firm’s 401(k) menu.

Your training is in law. Solving problems for your clients. Meeting challenges and finding creative solutions for our clients daily. You are not a trained money manager.

A Registered Investment Adviser, Ric Lager works with attorneys and law firms to help improve their 401(k) investment management decisions.

In this CLE he will primarily address:

• The greatest current challenges legal professionals face with 401(k) investment management.

• The real costs for legal professionals to own the wrong 401(k) mutual funds.

• Important changes to consider in your firm’s 401(k) mutual funds now.

• How the myths of diversification, asset allocation, and rebalancing continue to plague your 401(k).

• How to use the self-directed 401(k) brokerage account to your advantage.

• How to limit losses in your 401(k) limiting losses.

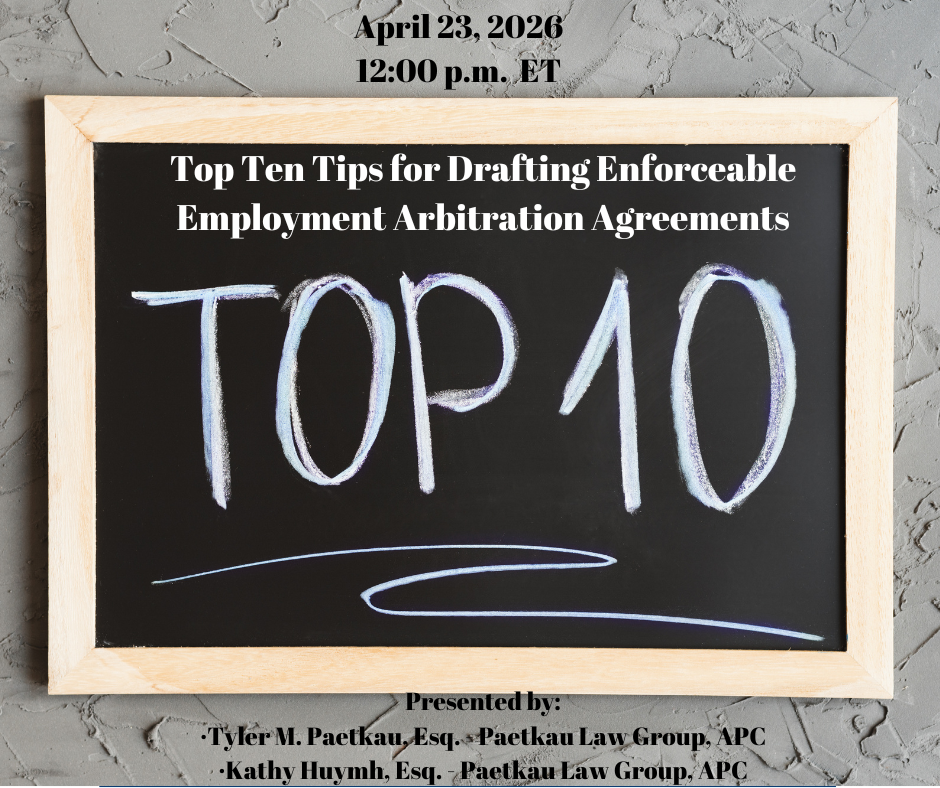

In the rapidly evolving landscape of employment law, arbitration agreements have become a cornerston...

The filing of multiple RICO complaints in federal courts in New York State against plaintiffs’...

This program provides a detailed examination of the Black Market Peso Exchange (BMPE), one of the mo...

Resilience in the Workplace, delves into the critical importance of resilience in navigating the cha...

Effective data privacy and artificial intelligence governance programs do not happen by accident. Th...

‘A Lawyer’s Guide To Mental Fitness’ is a seminar designed to equip professionals ...

Evidence Demystified Part 1 introduces core evidentiary principles, including relevance, admissibili...

This program examines critical 2025-2026 developments in patent eligibility for software and AI inve...

Large World Models (LWMs)— the next generation of AI systems capable of generating...

Attorneys hopefully recognize that, like many other professionals, their lives are filled to the bri...