Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

This course provides attorneys with a foundational understanding of Long-Term Care (LTC) Medicaid, including eligibility requirements, key terms, and allowable spenddowns. Participants will explore strategies such as Medicaid Asset Protection Trusts (MAPTs), their tax implications, and how they compare to other estate planning tools.

The course also covers LTC insurance and additional Medicaid planning strategies, equipping attorneys with the knowledge to help clients navigate the complexities of LTC Medicaid effectively.

• What is Long Term Care (LTC) Medicaid

• LTC Medicaid Eligibility Requirements

• Key LTC Medicaid terms

• Allowable Spenddowns

• LTC Insurance

• Medicaid Asset Protection Trusts (MAPT)

• Tax Considerations of MAPTs

• Estate Planning Comparisons

• Other LTC Medicaid Strategies

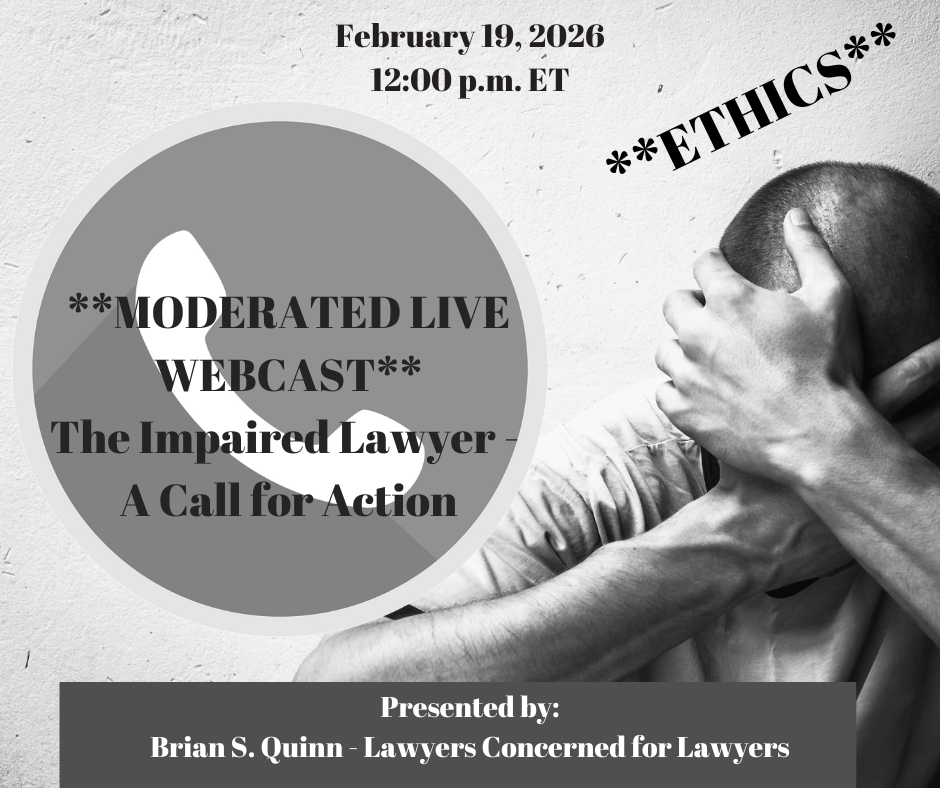

Recent studies have shown that there has been a dramatic increase in impairment due to alcoholism, a...

This presentation provides an overview of copyright law particularly as it applies to music. The pre...

Part 1 - This program focuses specifically on cross?examining expert witnesses, whose credentials an...

Attorneys will receive a comparative analysis of GAAP and IFRS with emphasis on cross-border legal c...

This course breaks down GAAP’s ten foundational principles and explores their compliance impli...

This CLE program covers the most recent changes affecting IRS information reporting, with emphasis o...

Part II builds on the foundation established in Part I by examining how classical rhetorical styles ...

If there is one word we heard during our journey through the pandemic and continue to hear more than...

This advanced CLE dives into complex GAAP topics relevant to attorneys advising corporate, regulator...

The “Chaptering Your Cross” program explains how dividing a cross?examination into clear...