Exciting new series on “Voice, Body and Movement for Lawyers – How to connect with the jury and find Justice Through Dramatic Technique!”

Click here to find out more

FinCEN has received millions of beneficial ownership information (BOI) reports, but many of the estimated 33 million entities that are required to file reports under the Corporate Transparency Act (CTA) still need to comply by January 1, 2025. This includes most businesses with an entity structure, such as LLCs, partnerships, and corporations, but there are exemptions to reporting. This CLE will educate you on the reporting requirements, how to analyze exemptions, and the mechanics of filing BOI reports.

The presenters will walk through hypotheticals and share their real-world experience with BOI reporting. The presenters will also discuss obligations to amend BOI reports, potential penalties for non-compliance and who will have access to the BOI database. This session will discuss the legal challenges to the CTA and the limited effect of recent rulings. Attendees will learn about state mini-CTA developments, including New York's LLC Transparency Act, and how these state laws align with the CTA.

Resilience in the Workplace, delves into the critical importance of resilience in navigating the cha...

Disasters, whether natural or manmade, happen. Disasters can impact the practice of law and, among o...

In this seminar, we will talk about the process of taking a deposition, why you should (or should no...

Loneliness isn’t just a personal issue; it’s a silent epidemic in the legal profession t...

This program focuses on overcoming the inner critic—the perfectionist, self?doubting voice tha...

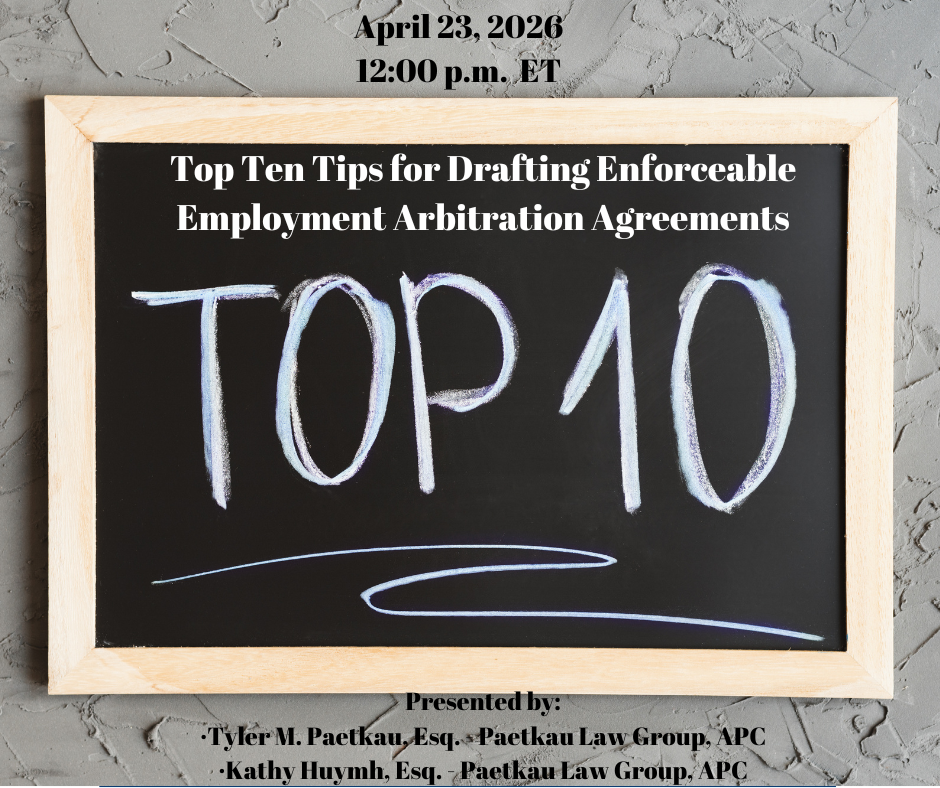

In the rapidly evolving landscape of employment law, arbitration agreements have become a cornerston...

This CLE session introduces attorneys to budgeting and forecasting concepts used in corporate planni...

The filing of multiple RICO complaints in federal courts in New York State against plaintiffs’...

This presentation teaches attorneys how to deliver memorized text—especially openings and clos...

This course provides a strategic roadmap for attorneys to transition from administrative burnout to ...